Why are accounting and finance jobs in Limerick and Clare in high demand?

Accounting and finance jobs in Limerick and Clare have never been so plentiful. There has never been a better time to work in this field and this location. The high number of accounting and finance jobs in the Midwest of Ireland is due to a number of factors, including the presence of multinational companies, booming industry, a skilled and educated workforce, favourable tax policies, and the country’s overall pro-business environment. Additionally, the Irish government has made a significant investment in the region to support economic growth and attract international businesses.

- Big 4 Presence: Accounting and finance jobs in Limerick and Clare are plentiful because of large scale multinational investment. These include finance and accounting firms such as the big 4 (PwC, Deloitte and EY) , which drives demand for skilled workers in these fields.

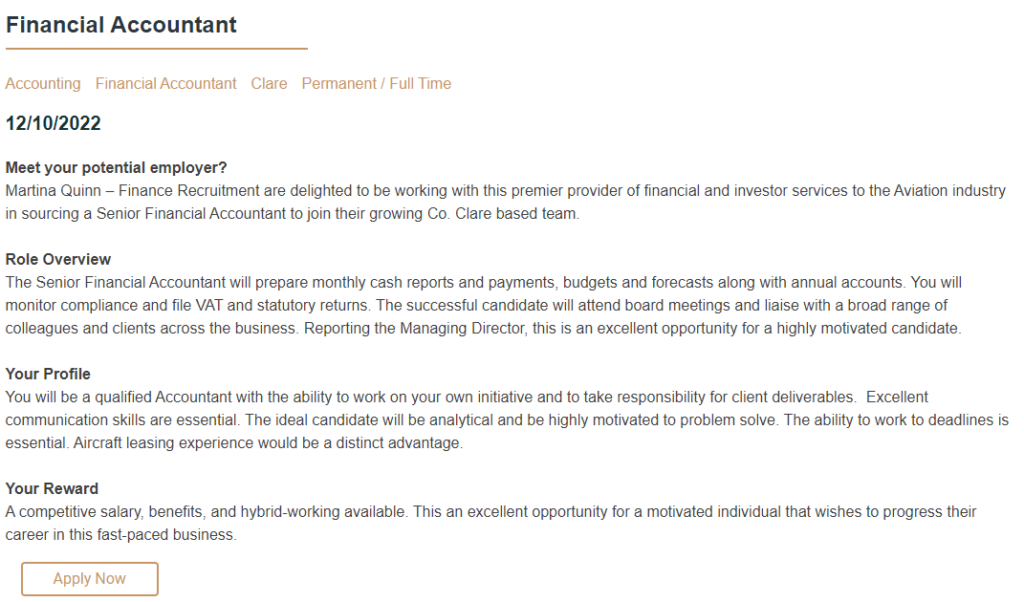

- Booming Industry: The aviation industry in Shannon, has experienced significant growth in recent years, leading to a boom in the region. This growth has created numerous job opportunities in the field of accounting and finance, as companies in the aviation sector require professionals to manage their financial operations. The increase in demand for accounting and finance professionals has made these roles highly competitive and lucrative, with many offering competitive salaries and benefits. Additionally, the presence of major aviation companies in the region has also attracted other businesses, further boosting the local economy and creating even more job opportunities.

- Skilled Workforce: Limerick and Clare have a highly educated and skilled workforce, which is attractive to employers in the finance and accounting sector. This skilled workforce have also access a solid education foundation with excellent undergraduate and postgraduate courses in UL and NUIG before becoming fully qualified with an accreditation from ACCA, ACA CPA and, or CIMA.

- Favourable Tax Policies: Ireland has a favourable corporate tax system, which has attracted many multinational corporations and helped to drive growth in the finance and accounting sector. The Irish government has implemented several tax incentives and exemptions, making it an attractive location for international companies to establish their operations and minimize their tax liabilities Some specific tax benefits in Ireland include:

- Corporation Tax: Ireland has a low corporation tax rate of 12.5%, which is one of the lowest in Europe. This helps companies to reduce their tax burden and retain more profits.

- Intellectual Property (IP) Tax Regime: Ireland has a favorable IP tax regime that allows companies to claim tax relief on income generated from IP assets such as patents, trademarks, and copyrights.

- Double Taxation Treaties: Ireland has signed numerous double taxation treaties with other countries, which help to prevent companies from being taxed twice on the same income.

- Tax Credits and Exemptions: There are several tax credits and exemptions available to companies in Ireland, such as the Research & Development (R&D) tax credit, which helps companies to offset the costs of R&D against their taxable income.

- These favourable tax policies have helped to make Ireland an attractive location for multinational corporations, including finance and accounting firms, and have helped to drive job growth in the finance and accounting sector in the Midwest region, including Limerick and Clare.

- Pro-Business Environment: The Irish government has created a pro-business environment, with support for foreign investment and a focus on developing the economy. This has helped to attract and retain finance and accounting jobs in the region. Ireland offers large tax incentives and low corporate taxes that have attracted many international businesses to the region. This has resulted in a strong demand for accounting and finance professionals, with many local and international companies looking to hire qualified accountants and financial analysts in Limerick and Clare. The dynamic environment is conducive to growth and progress, offering exciting opportunities for those working within the accounting and finance industries.

- Investment in the Region: The government has made significant investments in the midwest region to support economic growth and attract international businesses, which has helped to drive job creation in the finance and accounting sector. The Mid West Action Plan for Jobs, which covers these two counties, seeks to attract and retain investment through a strong knowledge capital base . This plan has resulted in “huge” job growth, with 21,800 jobs generated (13%) over the past decade . This has been beneficial to the accounting and finance sector, with more job opportunities and increased job security in the region .

Summary

Limerick and Clare are two Irish counties offering a range of accounting and finance jobs. such as qualified positions like financial accountants to audit seniors and financial directors, there is a wide selection suitable for job seekers of all levels of experience. The Midwest offers a number of businesses, both large and small, in the finance and accounting industries, making them an ideal location for those looking to begin or continue a career in these fields. Numerous universities, colleges and institutes provide professional courses in accounting and finance and the nearby Shannon International Airport ensures that candidates from all over the world can easily access Limerick and Clare. With both local and international job opportunities, Limerick and Clare are great places to start or enhance a career in accounting and finance.

Check out the latest jobs from the region

What we can do for you

Martina Quinn Finance Recruitment specialises in the placement of qualified accountants up to executive level nationwide, Our teams have extensive experience (67 years combined) recruiting in the Irish Market. Reach out to the team here at Martina Quinn Finance Recruitment for the best advice and support in building your finance teams contact us today.